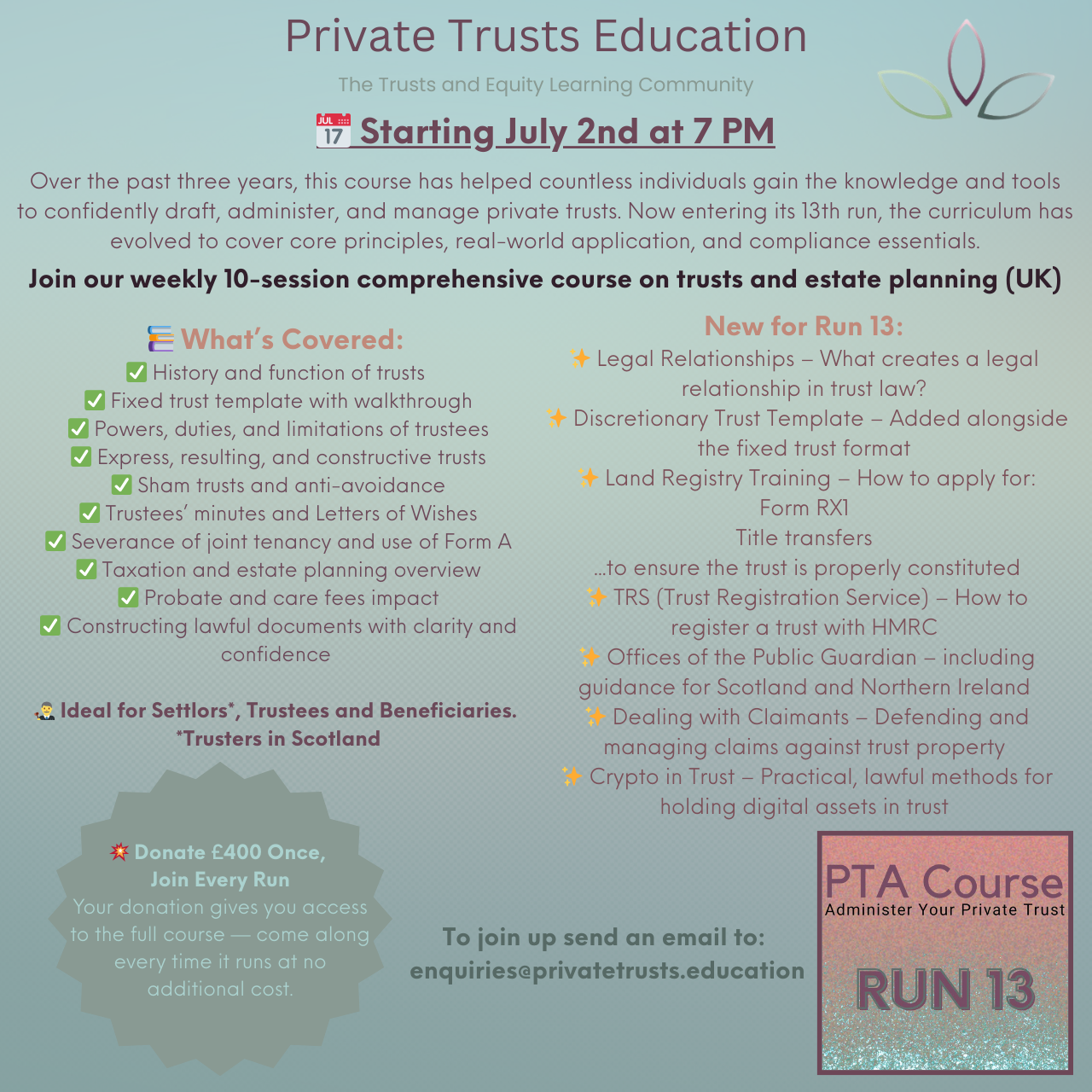

5. What is the Difference Between a Public Trust and a Private Trust?

Both public and private trusts involve a legal arrangement where a settlor transfers assets to a trustee, who manages them for the benefit of designated beneficiaries. While they share some fundamental characteristics, key differences in their structure, purpose, taxation, and privacy aspects set them apart.

Public (Charitable) Trusts:

Purpose: Public trusts, often referred to as charitable trusts in the UK, are established for charitable purposes that benefit the public or a significant segment of it. They must meet specific criteria defined by UK law to qualify as charitable.

Taxation: Charitable trusts enjoy substantial tax benefits in the UK. They are typically exempt from inheritance tax, capital gains tax, and income tax, provided they comply with the regulations set by HMRC and the Charity Commission.

Transparency and Enforcement: Charitable trusts are required to register with the Charity Commission if their income exceeds a certain threshold. This registration ensures a degree of transparency and accountability, as these trusts must adhere to reporting and operational standards. The Charity Commission oversees these trusts, ensuring they fulfill their charitable purposes.

Private Trusts:

Purpose: Private trusts are set up for the benefit of specific individuals or families. They are not designed for public benefit and, therefore, do not qualify for the same tax exemptions as charitable trusts.

Taxation: The taxation of private trusts in the UK can be complex and varies depending on the trust’s structure, the type of assets involved, and the beneficiaries. Generally, assets in a private trust are subject to inheritance tax, capital gains tax, and income tax under different rules and thresholds than personal assets.

Privacy: Private trusts offer a degree of confidentiality concerning the beneficiaries and the specifics of the trust assets. However, UK law requires compliance with anti-money laundering regulations, which may necessitate disclosing certain information to financial institutions or authorities.

Discretionary Trusts: Within private trusts, discretionary trusts provide trustees with the flexibility to make decisions about how and when to distribute assets to beneficiaries. This can be particularly useful for managing assets for beneficiaries who may not be capable or responsible enough to handle large sums directly.

Enforcement and Administration:Regardless of the type, all trusts require diligent administration. Trustees must act in accordance with the trust’s terms and the beneficiaries’ best interests, adhering to legal and fiduciary responsibilities. While public trusts benefit from regulatory oversight, private trust enforcement is largely the responsibility of the trustees and beneficiaries, who may need to take legal action if the trust is not administered as intended.

Understanding the distinctions between public and private trusts is crucial for settlors, trustees, and beneficiaries. Each type of trust serves different purposes and comes with its own set of legal, tax, and administrative considerations. Whether establishing a trust for charitable aims or private benefits, it’s essential to navigate these complexities carefully to ensure the trust fulfils its intended purpose effectively.