Take Advantage of The Tax Allowances

Inheritance tax (IHT) in the UK, often referred to as ‘death duty’, can be a significant concern, especially with the standard 40% rate applied to portions of estates exceeding certain thresholds. However, understanding key allowances like the residential nil rate band (RNRB), the transferable nil rate band between partners, and strategic estate planning can help mitigate this burden.

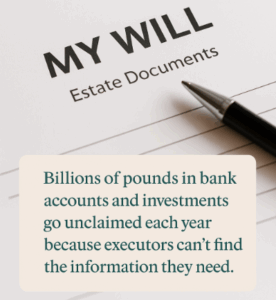

Overview of Inheritance Tax and Nil Rate Bands: Inheritance tax is charged on the estate of a deceased person, including their property, money, and possessions. The standard nil rate band (NRB) is £325,000, above which the IHT rate is 40%. However, there are additional reliefs and allowances that can significantly reduce this liability.

The Residential Nil Rate Band (RNRB): The RNRB, introduced in April 2017, is an additional allowance for those passing their home to direct descendants. This allowance is £175,000, which when combined with the standard NRB, brings the total IHT-free allowance to £500,000 per testator.

Transferring NRB Between Spouses: Crucially, married couples and civil partners can pass their unused NRB and RNRB to the surviving spouse. This means that the surviving partner could potentially have up to £1 million in combined NRBs (£500,000 from each partner), significantly reducing the IHT liability on their estate.

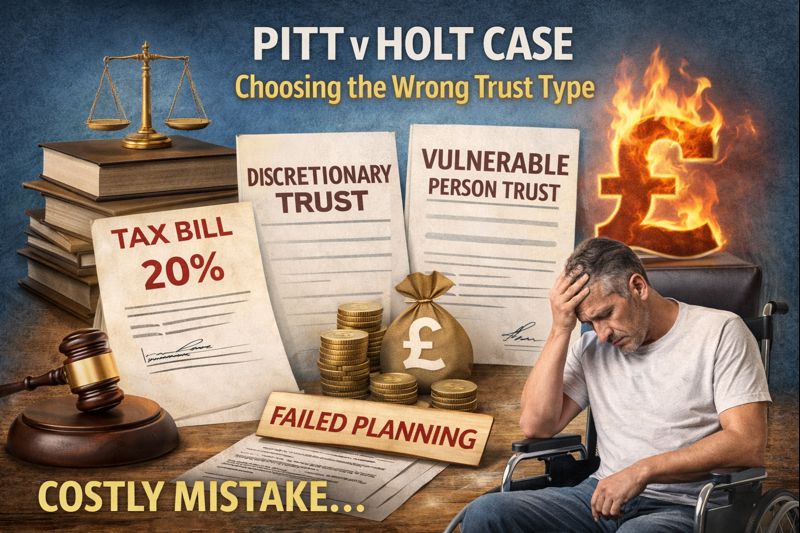

Lifetime Trusts for IHT Reduction: Placing assets into a trust during your lifetime can also be a strategy to reduce the IHT rate from 40% to 20%, subject to surviving seven years after the transfer. Lifetime trusts require careful planning and professional advice due to their complexity.

Taper Relief for Gifts: Gifts made more than three years before death can benefit from taper relief, which reduces the IHT rate on a sliding scale, depending on the time elapsed between the gift and death.

Gifting Property to Offspring: Consider the implications of passing property to your offspring before death. This strategy can reduce your estate’s value for IHT purposes but comes with considerations like capital gains tax and loss of control over the asset. Be aware of gift with reservation of benefit traps though.

Effective inheritance tax planning is essential for ensuring your estate is managed according to your wishes with minimal tax burden. Utilising allowances such as the RNRB and the transferable NRB between spouses, along with strategies like lifetime trusts and early gifting, can make a significant difference. It’s crucial to seek professional advice to navigate these options and tailor a plan that suits your unique circumstances and goals.

2 comments