The Pros and Cons of Registering Private Trusts with the Trust Registration Service (TRS)

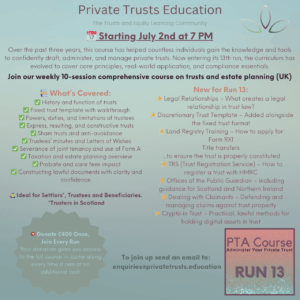

The Trust Registration Service (TRS) is a significant regulatory mechanism under the UK’s anti-money laundering regulations. It requires almost all express trusts, whether taxable or not, to be registered with the HMRC. This move is aimed at increasing transparency around the ownership of assets, especially to prevent their use in illegal activities such as money laundering or tax evasion. However, for private trusts that maintain confidential agreements between settlors and trustees, the requirement to register has become a contentious issue.

Many private settlors are reluctant to register their trusts with the TRS due to privacy concerns, especially since these trusts are often set up specifically to keep beneficiaries’ details confidential. Despite this, failure to comply with TRS requirements can carry significant penalties. Below, we explore the pros and cons of registering a private trust with the TRS.

Pros of Registering a Private Trust with the TRS

1. Legal Compliance

Registering with the TRS ensures that the trust is fully compliant with UK regulations. The penalties for failing to register can range from fines to reputational damage for trustees and the settlor. By adhering to the regulations, trustees protect the trust from legal consequences and potential scrutiny by regulators.

2. Protection Against Suspicion of Illegality

A private trust that remains unregistered can raise concerns about the nature of the assets it holds. The TRS was introduced to combat money laundering and tax evasion, and by registering, trustees show a commitment to transparency in accordance with legal expectations. This can help safeguard the trust from unwanted attention by financial authorities.

3. Enhancing Trust Integrity

By registering the trust, trustees demonstrate good governance, which can enhance the trust’s reputation among beneficiaries and other parties. Registering can also offer peace of mind, as beneficiaries may become suspicious or uncomfortable if a trust remains unregistered, especially in today’s regulatory climate.

4. Streamlining Future Transactions

Certain financial transactions, such as opening a bank account or conducting high-value transactions involving the trust, will require evidence that the trust is registered. By complying with the TRS, the trustees avoid unnecessary delays or refusals in such dealings.

Cons of Registering a Private Trust with the TRS

1. Privacy Concerns

The primary drawback for many settlors and trustees is the loss of privacy. The TRS requires the disclosure of personal details, including the names and addresses of the settlor, trustees, and beneficiaries. For private trusts set up to keep this information confidential, especially in cases where beneficiaries are minors, vulnerable individuals, or where there is a desire for discretion, this is a major concern.

Although the TRS is not a publicly accessible register, certain authorities and financial institutions have access to it, which might still be seen as a breach of privacy. The disclosure of beneficiaries, even to limited parties, can conflict with the initial purpose of maintaining a private agreement.

2. Administrative Burden

Registering a trust can be an administrative burden, particularly for trustees managing multiple trusts or those unfamiliar with the TRS process. It requires the collection and updating of personal information regularly. The process of complying with updates, correcting inaccuracies, and maintaining detailed records for each trust can be resource-intensive.

3. Potential for Misuse of Data

Though access to the TRS is restricted, there remains a concern about the potential misuse of personal data. Trustees and settlors might fear that the sensitive information held by the TRS could, in the wrong hands, lead to financial exploitation or harm to beneficiaries. Even if the risk is minimal, the perception of vulnerability can deter compliance.

4. Breach of Confidentiality Agreements

Many private trusts are based on confidentiality agreements between the settlor and trustees, which explicitly prohibit the disclosure of beneficiaries’ details. Registering the trust with the TRS could potentially violate these agreements, leading to legal complications between the settlor and trustees.

Balancing Compliance with Privacy

The decision to register a private trust with the TRS is a delicate balancing act between complying with legal requirements and maintaining the confidentiality of beneficiaries. On the one hand, non-registration could result in penalties and increased scrutiny. On the other hand, registration can compromise the privacy that many settlors desire when creating a trust.

Recommendations:

- Trustees should explore potential solutions to protect privacy while ensuring compliance, such as utilising corporate trustees to shield individual identities where possible.

- It’s essential to review and possibly renegotiate confidentiality clauses in trust agreements to accommodate the requirements of TRS registration.

- Professional legal and tax advice is crucial for settlors and trustees to navigate this complex area effectively.

Balancing transparency with privacy in trust administration is increasingly challenging in the modern regulatory environment. Ultimately, full compliance with the law, coupled with creative strategies to safeguard privacy, offers the best path forward for private trust arrangements in the UK.

Corporate Trustees as a Shield for Personal Identities

A corporate trustee is a legal entity (usually a trust corporation or a company) that acts as a trustee instead of an individual. When a corporate trustee is appointed, the company’s name and details are entered into the TRS, rather than the personal details of the individual trustees. This provides an additional layer of privacy for the individuals behind the trust, particularly the settlors and beneficiaries.

How this shields individual identities:

- Corporate Registration: The TRS would reflect the corporate trustee’s details (such as the name and address of the company) rather than the personal details of individual trustees.

- Limited Disclosure: Corporate entities are typically required to disclose far less personal information than individual trustees. This can help limit the exposure of sensitive personal data, especially if the trust is holding private assets like family residences or involves vulnerable beneficiaries.

The Legal Status of Corporate Trustees

Corporate trustees are subject to the same legal duties and fiduciary responsibilities as individual trustees. They are bound by trust law to act in the best interests of the beneficiaries and must follow the terms set out in the trust deed. As a legal entity, a corporate trustee can continue to act even if individuals within the company change, offering continuity in trust management.

Advantages of Using Corporate Trustees for Privacy

- Increased Privacy: By using a corporate entity, the names of individual trustees, settlors, or even beneficiaries may not be directly exposed in the TRS, as the corporate entity acts on behalf of the trust.

- Professional Management: Corporate trustees often bring a level of professionalism and expertise to trust management, ensuring compliance with legal obligations while maintaining confidentiality.

- Continuity and Stability: Corporate trustees provide stability, as they are not affected by the personal circumstances of individual trustees (e.g., death, incapacity, or resignation).

While the corporate trustee acts as a shield for individual identities, the trust still needs to comply with TRS requirements, including the submission of relevant information about the trust’s assets and beneficiaries. However, the use of a corporate trustee allows for a strategic way to fulfill these obligations with minimal exposure of personal information.

- Corporate Veil: In cases where privacy is a priority, the corporate trustee effectively acts as a veil, representing the trust in public records, while individuals behind the trust remain less visible.

- Limiting Data Disclosure: Although the trust must still provide the names of beneficiaries to the TRS, the corporate trustee can help limit the distribution of this data by ensuring that only the required entities (e.g., HMRC and other relevant authorities) have access to it, rather than public or external bodies.

Practical Considerations and Legal Advice

- Selection of the Corporate Trustee: It’s important to select a reputable corporate trustee who understands both the privacy concerns of the trust and the regulatory landscape. Many corporate trustees are specialised firms that can offer tailored services to meet the specific needs of private settlors.

- Trust Deed Adjustments: The trust deed may need to be amended to ensure that the appointment of a corporate trustee aligns with the settlor’s intentions, especially if privacy is a primary concern.

- Cost Considerations: Corporate trustees typically charge for their services, which could be higher than the fees charged by individual trustees. This cost is often offset by the professional management and enhanced privacy they offer.

Appointing a corporate trustee provides an effective strategy for those wishing to protect their privacy while ensuring compliance with the TRS. The corporate trustee acts as a legal representative of the trust, reducing the visibility of individual trustees and beneficiaries in public records, while still adhering to legal obligations. This solution is particularly useful in private trusts where confidentiality is crucial, but regulatory compliance cannot be avoided.

Why Beneficiaries’ Privacy Remains an Issue

The TRS requires trusts to provide specific information about beneficiaries, regardless of whether a corporate or individual trustee is in place. This means that even if a corporate trustee is appointed, the following details about beneficiaries must still be submitted:

- Name

- Date of birth

- National Insurance number (or an address if no NI number is available)

This means that the appointment of a corporate trustee, while helpful in shielding trustees’ identities, does not prevent the required disclosure of beneficiary information under the TRS regulations.

Potential Strategies to Enhance Beneficiary Privacy

While complete anonymity of beneficiaries is not possible under the TRS, there are some strategies that might help enhance privacy while still ensuring compliance:

1. Use of Class of Beneficiaries

Instead of naming individual beneficiaries, a trust can identify beneficiaries as part of a broader class (e.g., “my children” or “my descendants”). The TRS allows for the registration of beneficiaries as a class, which can offer some degree of privacy, particularly if the class of beneficiaries is large or undefined at the time of registration. However, specific individuals in the class will need to be identified when distributions are made.

- Benefit: This approach may avoid having to name all individual beneficiaries upfront, offering some level of privacy until distributions occur.

- Limitation: The beneficiaries will still need to be disclosed eventually if they receive benefits from the trust.

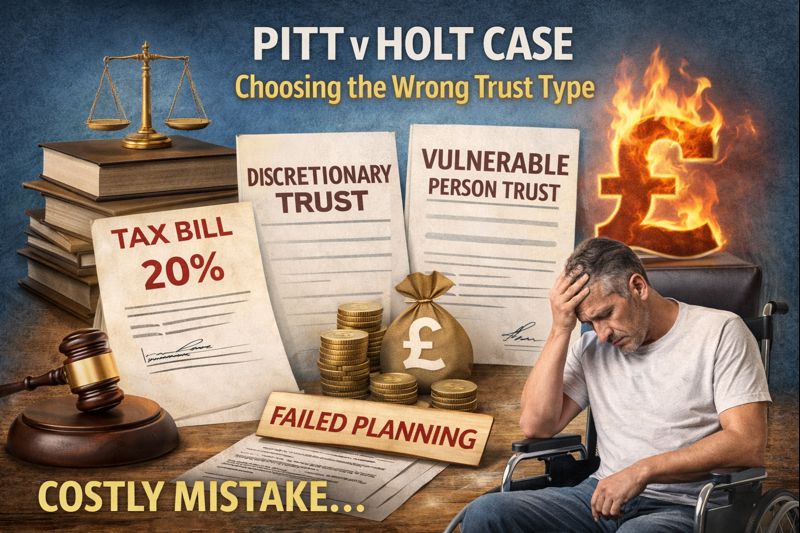

2. Discretionary Trusts

In a discretionary trust, the trustees have the discretion to decide which beneficiaries receive distributions and when. While the names of potential beneficiaries must still be disclosed to the TRS, discretionary trusts offer some flexibility regarding when and how these beneficiaries are identified.

- Benefit: A discretionary trust might help minimise the immediate identification of beneficiaries, especially if the trustees have the power to defer distributions or alter the list of potential beneficiaries.

- Limitation: This is only a partial privacy solution, as beneficiaries must still be registered even if they are not guaranteed to receive assets.

3. Appointing Offshore Trusts or Sub-trusts

In some cases, settlors may use offshore trusts or sub-trusts in jurisdictions with less stringent registration requirements to hold certain assets or manage beneficiary distributions. While this might reduce the information reported to the UK TRS, it comes with increased complexity and regulatory oversight in offshore jurisdictions.

- Benefit: Offshore trusts may provide an additional layer of privacy protection for beneficiaries.

- Limitation: This strategy requires careful legal planning to avoid tax liabilities and compliance issues, and it may not be suitable for all trusts.

4. Use of Professional Advisors for Reporting

Instead of the trustees directly submitting details to the TRS, professional advisors (e.g., legal or tax advisors) can manage the reporting process. While this does not directly affect the privacy of beneficiaries, it ensures that sensitive information is handled with the highest level of confidentiality by professionals.

- Benefit: Professional advisors can ensure compliance while managing the process with discretion, reducing the risk of improper disclosure.

- Limitation: This does not prevent the required disclosure of beneficiary information to the TRS itself.

5. Letters of Wishes

Some trusts include a Letter of Wishes, which provides informal guidance to trustees on how the trust’s assets should be distributed. While not legally binding, a letter of wishes can offer further flexibility on when beneficiaries are identified and can help trustees make decisions about privacy-sensitive distributions.

- Benefit: Since a letter of wishes is not a legal document, it does not need to be disclosed publicly or submitted to the TRS, preserving some privacy for beneficiaries.

- Limitation: The TRS still requires reporting of beneficiaries, so this can only serve as a supplemental privacy tool.

Conclusion

While appointing a corporate trustee provides substantial privacy for trustees and settlors, the TRS requirements make it difficult to fully shield beneficiaries’ identities. However, using strategies such as registering classes of beneficiaries, setting up discretionary trusts, and utilising professional advisors can provide some degree of privacy protection. Ultimately, balancing compliance with privacy in today’s regulatory environment requires careful structuring of the trust and, in many cases, creative legal solutions.

Post Comment