What Happens to Your Digital Assets When You Die?

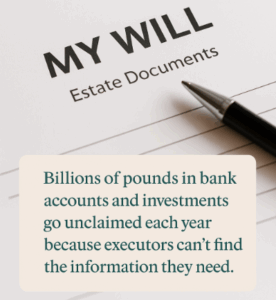

In a world where data is currency and online access underpins wealth, privacy, and identity, the question is no longer if your digital assets matter, but whether they’ve been adequately planned for.

Whether you’re a private individual with online investment portfolios or someone safeguarding family wealth through trusts, your digital footprint is part of your estate. And unlike traditional assets, it can vanish permanently if not accounted for with foresight.

What Are Digital Assets?

Digital assets are more than just social media accounts. They may include:

- Encrypted email communications

- Online investment accounts and banking platforms

- Cryptocurrency holdings

- Personal or business cloud storage (Google Drive, iCloud, OneDrive)

- Digital intellectual property (eBooks, course content, NFTs)

- Online businesses or digital storefronts

- Web domains and hosting accounts

- Passwords stored in digital vaults

- Photo archives, journals, or private records

For families seeking discretion, generational continuity, or structured asset protection, these assets can be highly sensitive, or of considerable financial value.

Why Private Planning is Critical

Digital assets are frequently locked behind encryption, two-factor authentication, or bound by terms of service that prevent even legally appointed executors from gaining access without explicit permission or court orders.

For those managing private wealth or operating through trusts, the implications are serious:

- Beneficiaries may be unaware of what exists

- Encrypted holdings may be lost forever

- Online businesses could fail without transition plans

- Private communications or legacy material may become inaccessible

And unlike traditional financial institutions, many tech platforms do not recognise Wills or probate documents as sufficient authority without a prior digital directive.

Practical Steps for High-Integrity Digital Estate Planning

1. Maintain a Secure Digital Asset Register

Catalogue your accounts, access credentials, and encryption keys. Consider using offline encrypted storage or secure digital vaults with limited trustee access.

2. Nominate a Digital Asset Trustee or Steward

This may or may not be the same as your executor or primary trustee. Technical capability and trustworthiness are both essential.

3. Leave Explicit Instructions

What should happen to each digital asset?

- Should data be archived, erased, or transferred?

- Should crypto wallets be liquidated or held long-term?

- Are certain communications to be preserved for family or destroyed?

4. Use Platform-Specific Legacy Tools

Many online services (e.g. Facebook, Google) now allow you to define what happens to your account after death. These tools should be configured in advance.

5. Integrate Digital Assets into Your Trust Structure

In some cases, digital assets can be included in the trust itself or referenced within accompanying documentation. Take advice to ensure regulatory compliance, especially where crypto is concerned.

A Note on Cryptocurrency

Decentralised by design, cryptocurrencies such as Bitcoin and Ethereum offer privacy, but also risk. If private keys or seed phrases are lost, the asset is lost permanently.

For crypto holders:

- Document your keys securely, away from cloud storage

- Consider hardware wallets with written access instructions

- Ensure at least one trusted party knows how to retrieve and manage them

- Be mindful that these are taxable and form part of the estate

True privacy and asset protection don’t stop at the traditional — and in this digital age, failing to plan for online assets leaves a gap in even the most robust estate strategies.

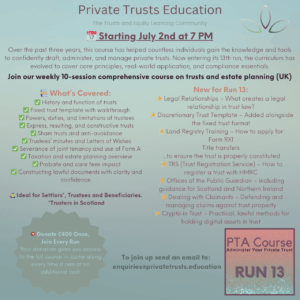

At Private Trusts Education, we provide the knowledge and frameworks to ensure your digital and physical wealth are protected, structured, and transferred seamlessly across generations.

Ready to Learn More?

Whether you’re designing a private trust, exploring crypto succession, or auditing your digital footprint, we can help you take control with confidence.

🌐 Visit: www.privatetrusts.education

📧 Email: admin@privatetrusts.education

Disclaimer: This article is for educational purposes only and does not constitute legal or financial advice. We recommend seeking tailored professional guidance before taking action.

Post Comment