Your Will Doesn’t Control Everything!

What Actually Passes Outside Your Estate

For most people, a Will feels like the final word. It’s the document that says who gets what, how things should be divided, and what your wishes are after death. But here’s the uncomfortable truth:

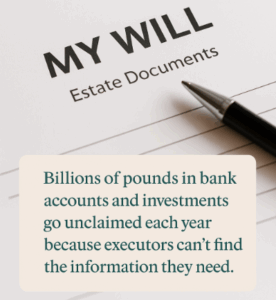

A significant amount of wealth never passes under your will at all.

Instead, it bypasses your estate entirely, sometimes quietly, sometimes disastrously, and this is one of the biggest sources of shock, confusion, and family disputes after someone dies.

What Does “Outside the Estate” Mean?

When an asset passes outside the estate, it means it does not form part of the assets controlled by your Will or your executors. Probate doesn’t touch it. Your carefully drafted clauses don’t apply. The asset moves automatically according to ownership structure, contract terms, or trustee discretion.

People are often stunned to learn that their Will, however clear, simply has no power over certain assets.

Common Assets That Bypass Your Will

Here are the most common culprits.

1. Jointly Owned Property (Joint Tenants)

If you own a property as joint tenants, it passes automatically to the surviving owner on death, regardless of what your Will says.

This catches families out all the time. A Will leaving the estate equally to children does not override survivorship. The house never enters the estate.

2. Pensions and Death Benefits

Most pension death benefits are held under discretionary trusts. Trustees decide who receives the money, guided by your nomination form, not your Will.

If your nomination is outdated (for example, it still names an ex-spouse), the outcome can be very different from what you intended. Make sure you have updated your letter of wishes.

3. Death-in-Service Benefits

Often overlooked, these benefits can be substantial. They are usually paid at trustees’ discretion and sit entirely outside the Will.

4. Life Insurance Written in Trust

Life policies placed in trust pay out directly to beneficiaries, often very quickly, but again, not under the Will.

5. Joint Bank Accounts

Joint accounts usually pass automatically to the surviving account holder. Even if the Will says otherwise, the money does not form part of the estate.

The problem is that people assume everything is governed by the Will

Why This Causes Problems

The issue isn’t that these mechanisms exist, many are useful and efficient. The problem is that people assume everything is governed by the Will, when legally it isn’t.

This leads to:

- Unequal distributions where equality was intended

- Children or partners receiving far more (or less) than expected

- Executors being blamed for outcomes they couldn’t control

- Family disputes fuelled by surprise rather than malice

One of the most common phrases we hear is:

“That’s not what they would have wanted.”

Often, that’s true, but intention alone isn’t enough.

Why the Law Works This Way

Ownership and contract matter. If you jointly own something, the law prioritises certainty and continuity. If trustees hold assets, they exercise discretion. If a policy is written in trust, it follows the trust.

Your will reflects what you want to happen, but ownership structures determine what can happen.

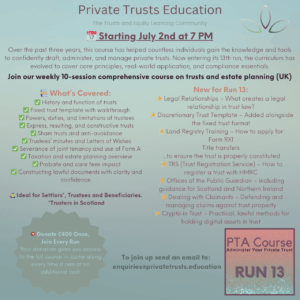

How to Bring Everything Back Into Line

Good estate planning isn’t about adding complexity; it’s about coordination.

That means:

- Reviewing how property is owned (joint tenants vs tenants in common)

- Keeping pension and death benefit nominations up to date

- Checking life policies and whether they’re in trust

- Ensuring your will aligns with everything that sits outside it

This is why a will should never be looked at in isolation.

The Quiet Lesson

Most inheritance problems aren’t caused by bad intentions. They’re caused by assets passing outside the estate without anyone realising.

A properly coordinated estate plan ensures your wishes aren’t accidentally overridden by ownership structures, outdated nominations, or default rules.

Post Comment