Vulnerable Person Trusts vs Discretionary Trusts: What’s the Difference and Why It Matters.

This is one of those topics where people nod politely while secretly thinking, “A trust is a trust, right?”

Not quite. And choosing the wrong one can have real consequences, particularly where benefits are involved. Here’s a case where it did:

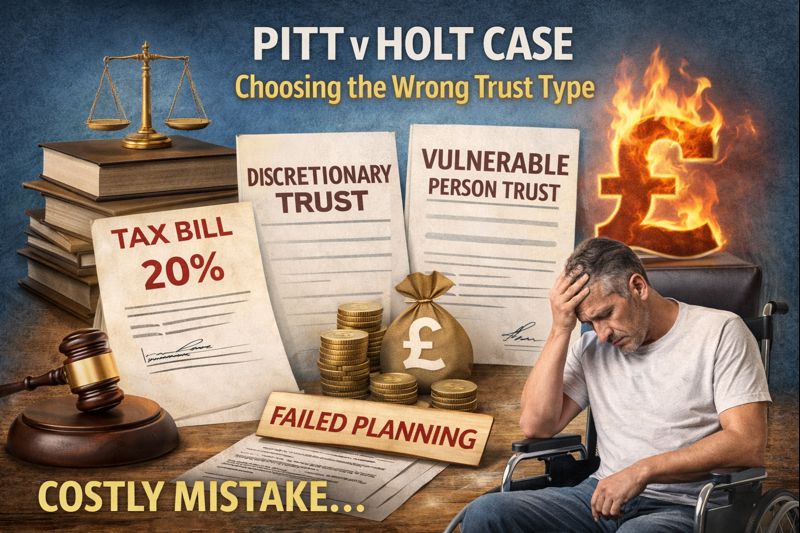

Pitt v Holt [2013] UKSC 26

Mr Pitt was left severely disabled following a road traffic accident. He received substantial personal injury compensation. Sensibly, the money was put into a discretionary trust, with the intention of protecting his means tested benefits.

So far, so good.

The problem was tax. A standard discretionary trust triggered an immediate inheritance tax charge at the lifetime rate of 20%, because the settlement exceeded the nil rate band. On top of that, it exposed the trust to ongoing periodic and exit charges. In short, the tax bill was eye watering and completely unnecessary.

What should have been used was a Vulnerable Person Trust, which would have avoided those charges and protected benefits at the same time.

The legal fight

The trustees applied to have the trust set aside, arguing that the trust had been created based on flawed professional advice. Initially, the courts allowed it to be unwound using the old doctrine of mistake.

However, the case went all the way to the Supreme Court, which tightened the law significantly. The Court confirmed that a trust can be set aside for mistake, but only where the mistake is serious and relates to the legal effect or tax consequences, not just disappointment with the outcome.

In Pitt’s case, the trust was ultimately reversed, but the legal battle itself was long, complex, and expensive. Not exactly a relaxing way to manage a vulnerable person’s compensation.

Why this case still matters

Pitt v Holt is now the textbook example of why choosing the wrong type of trust can be catastrophic. It also underlines this uncomfortable truth:

Good intentions do not cancel out bad drafting.

It’s also why personal injury awards, vulnerable beneficiaries, and trusts should always ring alarm bells for careful, specialist planning. A discretionary trust and a Vulnerable Person Trust are not interchangeable, and the tax system will absolutely punish you for pretending they are.

Let’s break it down.

The Big Picture

Both Vulnerable Person Trusts and Discretionary Trusts are designed to hold assets for someone’s benefit rather than giving them money outright. That’s where the similarity ends. The purpose, tax treatment, and impact on benefits can be very different.

What Is a Discretionary Trust?

A Discretionary Trust gives trustees full control over how and when funds are paid out. No beneficiary has an automatic right to the money. This flexibility is exactly why it’s so popular.

One important technical point: to be discretionary, there must be at least two potential beneficiaries. One alone simply doesn’t cut it. Think of it as giving trustees options rather than a single destination.

Discretionary trusts are often used to protect assets from divorce, bankruptcy, or young adults who might confuse a lump sum with a licence to shop.

What Is a Vulnerable Person Trust?

A Vulnerable Person Trust is a specific type of discretionary trust, designed for someone who is vulnerable due to disability, illness, or limited capacity.

The key difference is how it is treated for tax and benefits. When properly drafted and administered, a Vulnerable Person Trust can protect means tested benefits and attract favourable tax treatment. That combination is powerful.

In short, it’s a trust with a very specific job to do, and it does it well.

Benefits Protection: The Deciding Factor

Here’s the blunt truth.

A standard Discretionary Trust may affect benefits.

A Vulnerable Person Trust is designed not to.

If the beneficiary relies on means tested benefits, this distinction matters. A lot. I’ve seen well meaning planning unravel because the wrong trust was used.

Tax Treatment

Vulnerable Person Trusts can benefit from special tax rules that don’t apply to ordinary discretionary trusts. That can mean less tax paid and more money available to support the person who needs it.

This only works if the trust is drafted correctly. Close enough is not good enough here.

Lifetime or Will Based?

Both trusts can be set up during your lifetime or within a will. The choice depends on when support is needed and how much control you want now versus later.

There’s no one size fits all. Anyone who says there is is overselling.

So Which One Should You Use?

If benefits are not an issue and flexibility is your main goal, a Discretionary Trust may be perfectly suitable.

If the beneficiary is vulnerable and relies on benefits, a Vulnerable Person Trust is usually the safer, smarter option.

The wrong trust can cost far more than the right advice ever would.

Final Thoughts

Trusts are not about being clever. They’re about being careful. The difference between these two can affect tax, benefits, and long term security. Getting it right protects not just money, but people.

And honestly, that’s the bit that actually matters.

Post Comment