How Farmers Can Use Trusts and Agricultural Property Relief to Optimise Inheritance Tax Planning

Inheritance Tax (IHT) planning is a crucial consideration for farming families looking to preserve generational wealth. With the availability of Nil Rate Bands (NRB), Agricultural Property Relief (APR), and strategic use of trusts, it’s possible to pass significant assets to children while minimising tax liabilities. This blog explores how couples can use trusts effectively, leveraging recent updates to APR and IHT rules (2024 Autumn Budget).

What is the Nil Rate Band (NRB)?

The Nil Rate Band is the threshold below which no IHT is payable. As of 2024, each individual has an NRB of £325,000. Married couples or civil partners can combine their NRBs, allowing them to transfer up to £650,000 tax-free.

For farmers, careful use of the NRB can be combined with other tax reliefs, such as APR, to enhance tax efficiency.

Using Trusts for Inheritance Tax Efficiency

A trust can be a powerful tool for IHT planning. By placing assets into a trust, you effectively remove them from your taxable estate, provided you survive seven years after the transfer. Here’s how it works:

Example 1: Using Combined NRB for Trust Transfers

A farming couple owns a farm valued at £1.5 million. They want to reduce their taxable estate by gifting parts of the farm to their children:

- Step 1: Every 7 years, they transfer £650,000 worth of farm property into a discretionary trust.

- Outcome: If both spouses survive the 7-year period, the transferred property is outside their taxable estate.

- Repeat: This process can be repeated every 7 years, enabling significant asset transfers over time without triggering IHT.

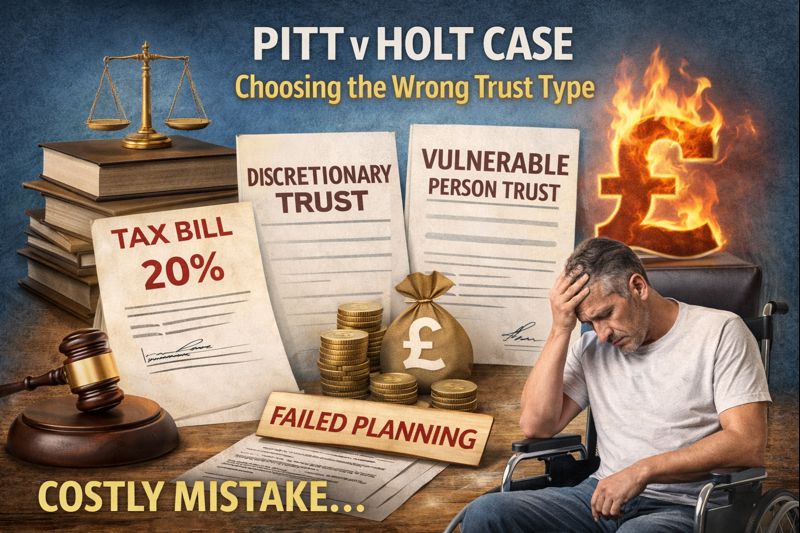

Since the £650,000 transfer is within the combined NRB, no entry fee (20% tax on the excess over NRB) is charged at the time of the transfer.

How Agricultural Property Relief (APR) Enhances the Strategy

APR provides relief from IHT on qualifying agricultural assets. Depending on the circumstances, it can exempt up to 100% of the agricultural value of the property from IHT.

Key Criteria for APR

- Agricultural Use:

- The property must be used for agriculture, including crops, livestock, or horticulture.

- Ancillary uses, such as shelter belts or woodlands, may qualify.

- Ownership Duration:

- The owner must have occupied the property for agricultural purposes for at least 2 years prior to transfer, or it must have been owned and used by someone else for 7 years.

- Qualifying Structures:

- Farmhouses must be character-appropriate and integral to the farm’s operations.

Example 2: APR on Farm Property in Trust

A couple transfers a farm property worth £1 million into a trust. The property qualifies for 100% APR, as it is actively used for agriculture. Key outcomes:

- The entire £1 million qualifies for APR, effectively exempting it from IHT.

- No entry fee is payable, even though the value exceeds the NRB, because APR offsets the taxable value.

By ensuring the property continues to meet APR conditions, the trustees can preserve this relief for future beneficiaries.

Understanding the Proposed Changes to APR

In the 2024 Autumn Budget, the government announced significant changes to APR, set to take effect from April 2026. Here’s a summary:

- Capping APR:

- Full 100% relief will apply only to the first £1,000,000 of combined agricultural and business assets.

- For values exceeding £1 million, the relief reduces to 50%, resulting in an effective IHT rate of 20% on the excess.

- Implementation Timeline:

- Changes will apply to estates from April 2026, following consultations in 2025.

Implications for Farmers

The proposed changes mean larger estates may face IHT liabilities on agricultural assets that previously qualified for full relief. Strategic planning, such as using trusts or leveraging both APR and Business Property Relief (BPR), will become even more critical.

The Importance of Periodic Charges and Trust Administration

While trusts can be an excellent way to minimise IHT, they come with ongoing obligations:

- Periodic Charges:

- Every 10 years, discretionary trusts are subject to a periodic charge on the value exceeding the NRB at that time.

- If the trust’s value is within the prevailing NRB (e.g., £650,000 for a couple), no periodic charge applies.

- Trust Management:

- Trustees must ensure the property retains its agricultural use to maintain APR.

- Proper record-keeping and compliance with tax rules are essential.

Bringing It All Together: Strategic Recommendations

- Evaluate Eligibility for APR:

- Ensure your farm assets meet APR criteria, including appropriate agricultural use and ownership duration.

- Plan Regular Transfers:

- Transfer up to £650,000 (for couples) into trusts every 7 years to utilise combined NRBs effectively.

- Consider larger transfers if APR can shield excess value from entry charges.

- Monitor Budget Changes:

- Keep an eye on upcoming APR reforms and prepare to adapt your estate plan to maintain tax efficiency.

- Professional Advice:

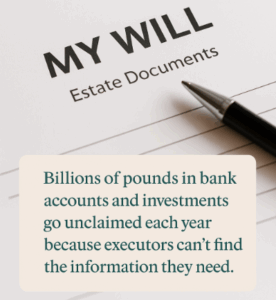

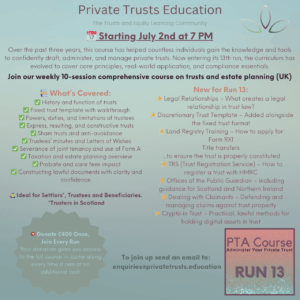

- Work with an estate planning expert to navigate complex rules around APR, BPR, and trusts.

Farming families can benefit significantly from using trusts and APR for inheritance tax planning. By leveraging combined NRBs, strategically transferring assets, and ensuring ongoing compliance with agricultural use requirements, you can reduce your taxable estate and secure wealth for future generations.

As proposed APR changes loom, now is the time to revisit your estate plan. Contact us for more details on how you can help yourself utilise these tools, available to all of us.

Post Comment