Not So Tax-Free: What Happens to CGT When You Put Your Home Into Trust

When people talk about putting their home into trust, it’s often in the context of planning ahead, for inheritance tax (IHT), asset protection, or long-term care mitigation (not to avoid, but to provide choice). But one crucial aspect is often overlooked:

Capital Gains Tax (CGT).

Most homeowners in the UK enjoy full exemption from CGT when they sell their main residence, thanks to Principal Private Residence Relief (PPR). But this relief isn’t guaranteed when the property is held in trust — and failing to understand the rules can leave clients with a surprising and significant tax bill.

What Is PPR and How Does It Work?

Principal Private Residence Relief (PPR) allows you to sell your main residence free of CGT, provided the property has been your only or main home throughout your period of ownership.

This relief applies to individuals — but things change when that same property is put into a trust.

What Happens to PPR in a Trust?

When a property is transferred into a lifetime trust, it triggers a disposal for CGT purposes. If the home has increased in value since it was purchased, this gain can be taxable unless PPR is claimed.

However, PPR is only available if:

- The beneficiary of the trust actually uses the property as their only or main residence, AND

- The trust allows that person to occupy the home as of right (for example, under a life interest or right to occupy clause).

If these conditions aren’t met, or if the trust is structured incorrectly, no PPR is available, and CGT will apply.

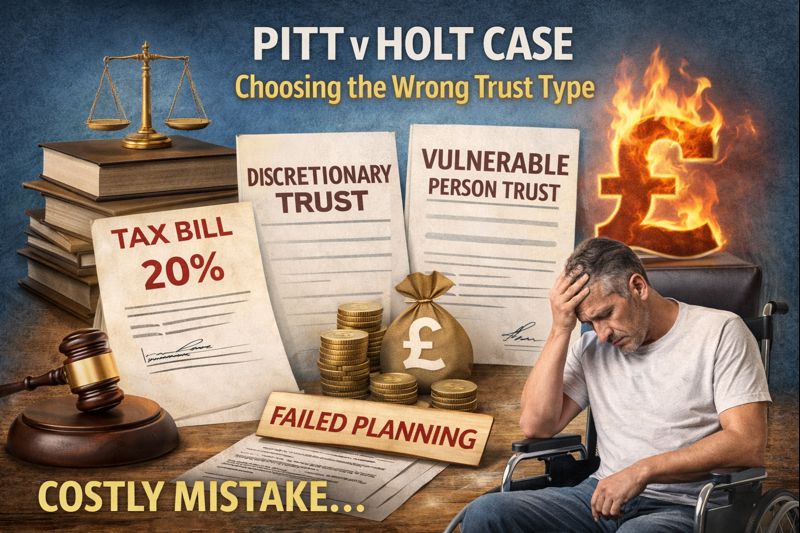

Case Example: Gifting the Family Home Into Trust

Let’s say John bought his home for £200,000. It’s now worth £500,000. He decides to put the home into a discretionary trust for his children. As the value has increased by £300,000, and he no longer retains a right to occupy, there is no PPR relief available. A CGT charge may arise immediately.

Had he structured the trust to retain a Right to Occupy or made it a lifetime interest trust, and continued living in the property as his main residence, PPR could still have applied.

Can You Claim PPR When Selling From a Trust?

Yes, but only in specific circumstances. If a property held in trust is sold, the trust may be able to claim PPR on disposal, provided:

- The beneficiary has been living in the home as their main residence, AND

- The trust structure gives them a qualifying interest in possession (like a FLIT or RtO).

The trustees must demonstrate that the property has genuinely been used as a principal private residence, utility bills, electoral roll, and other documentary evidence can support the claim.

Why This Matters for Estate Planning

Many clients assume that putting a house into trust protects it from tax and imposed care fees without consequence. But the truth is more nuanced:

- Outright gifting into trust without safeguards can lead to immediate CGT bills

- Loss of PPR relief can wipe out any perceived tax advantage

- HMRC is increasingly rigorous in investigating trust structures and use of reliefs

To avoid problems, it’s vital to ensure:

- The trust is structured properly, with rights of occupation clearly defined

- There is a qualifying interest in possession for CGT relief

- The beneficiary genuinely uses the home as their main residence

Final Thoughts

Using trusts for estate planning can be incredibly powerful, but without careful advice, the tax implications can be severe. Before putting your home into trust, make sure you understand the CGT exposure, and whether PPR can be preserved.

If you’re thinking of using a Family Lifetime Interest Trust (FLIT) or Right to Occupy clause, we can help you do it the right way.

Post Comment