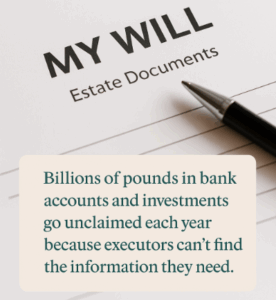

Private Trust Administration Course

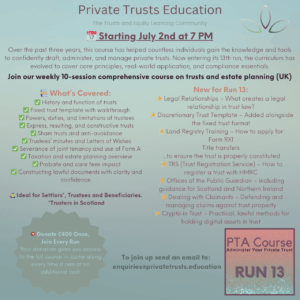

Private Trust Administration Course – Run 14

Starting Wednesday 14th January 2026 | 7PM (UK Time)

This ten-session live online course offers a deep and practical understanding of UK trust law, combining legal principles with real-world application. Whether you’re a settlor, trustee, beneficiary, or practitioner, this course will equip you with the clarity and confidence to administer private trusts effectively.

Now in its 14th run, the course has been fully updated with new material from Property and Private Client Law, offering essential insight into how trusts operate within conveyancing, estate planning, and probate practice.

Course Overview

Across ten sessions, participants explore the legal, historical, and practical foundations of trust administration. You’ll learn how trusts are created and managed, how trustees discharge their duties, and how trust law interacts with property registration, taxation, and estate planning. Each session blends theoretical explanation with applied examples drawn from UK legal practice.

Key Topics

- The nature, origin, and purpose of trusts in English law.

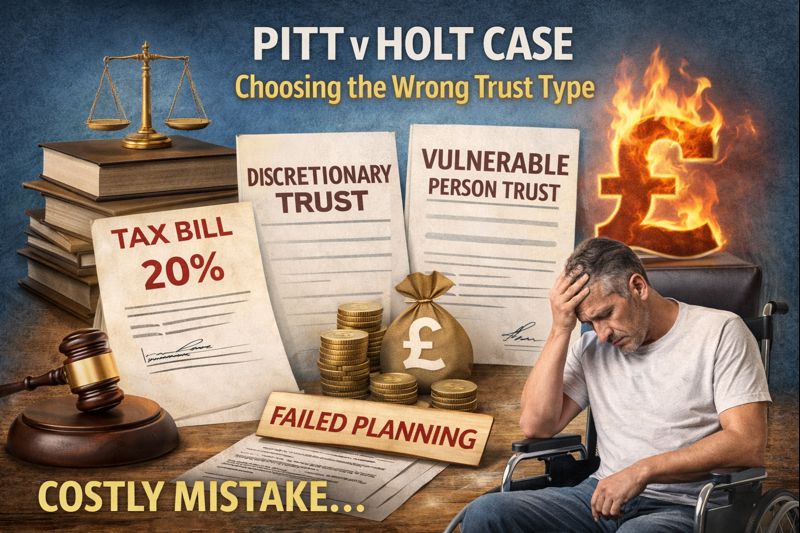

- The Three Certainties – intention, subject matter, and objects.

- Trust structures: Fixed, Discretionary, Hybrid, and Bare Trusts.

- Roles and fiduciary duties of trustees and rights of beneficiaries.

- Trust creation and constitution – properly forming and recording valid trusts.

- Land Registry & Property Law: restrictions (Form A/B), overreaching, and the Curtain Principle.

- Conveyancing Protocol & TA Forms – where trusts meet property transactions.

- Probate and estate administration – the trustee’s role after death.

- STEP Standard Provisions and their inclusion in wills and modern trust drafting.

- HMRC Trust Registration Service (TRS) – registration and compliance requirements.

- Crypto and digital assets – practical methods for holding and protecting them in trust.

Who This Course Is For

This course is designed for individuals acting as settlors, trustees, or beneficiaries.

Each session is structured to support both newcomers and experienced participants, ensuring clear, applicable understanding.

| Donation: | £400 (includes access to all future runs at no extra cost) |

| Start Date: | Tuesday 14th January 2026 |

| Duration: | 10 weeks (1-hour live weekly sessions) |

| Delivery: | Online via live Zoom class with recordings available |

| No. | Session | Description |

| 1 | Introduction to Trusts and Equity | Historical evolution of equity, legal vs equitable ownership, the Court of Chancery, the Three Certainties (Knight v Knight), and proper constitution (Milroy v Lord). |

| 2 | Trust Interests and the Land Register | Examines the three certainties—intention, subject matter, and objects—Legal vs beneficial ownership, Land Registration framework, restrictions (Form A/B), the Curtain Principle, and case studies: Williams & Glyn’s Bank v Boland and City of London Building Society v Flegg. |

| 3 | Types of Trusts and Beneficiary Interests | Discretionary, FLIT, Fixed and Hybrid trusts; settlor, trustee, and beneficiary roles; classes and interests; Schmidt v Rosewood and IRC v Broadway Cottages. |

| 4 | Trustee Duties and Fiduciary Responsibility | Roles, powers, fiduciary obligations (Downs v Chappell), certainty of intention (Paul v Constance), and sham trusts (Snook v LWR Investments). Includes Scottish law comparison and jurisdiction discussion. |

| 5 | Trust Provisions and STEP Standard Provisions | Statutory trustee powers (Trustee Acts 1925/2000), STEP Provisions (SSP3), perpetuity, and the use of deeds of gift to properly constitute and defend trusts. |

| 6 | Trust Operations and Administration | Settlor’s authority, trustee powers and duties, service addresses, trust banking, TRS compliance, storage of deeds (National Will Safe), and trustee indemnities (Muir v City of Glasgow Bank). |

| 7 | Executing and Evidencing a Trust | Affidavits (settlor/trustee), public notices, doctrine of notice (Hunt v Luck), sub-trusts, and severance agreements. |

| 8 | Land Registry Practice for Trusts | Completion of TR1, RX1, AP1, SEV, and ID1/ID5 forms for property held in trust; protecting the legal title and restrictions. |

| 9 | Trust Taxation and Compliance – Know it. | IHT, CGT, income tax implications; GROB rules, Section 102(b) IHTA declarations, and the Hastings-Bass principle; TRS reporting and compliance. |

| 10 | Holistic Estate Planning – what else do you need? | Explores how will trusts and LPAs connect to lifetime trust administration. Covers executor and trustee roles, drafting and interpreting will trusts, and continuity between death and trust management. Examines the use of STEP Standard Provisions in wills, appointment of trustees under probate, and how LPAs (Property & Financial Affairs / Health & Welfare) operate alongside private trusts. Provides practical guidance on integrating trusts into estate planning and legacy protection. |