The Realities of Trusts in the Truther Movement: Are They Always Necessary, and How Can They Be Mismanaged?

Trusts are often touted as a must-have for anyone thinking seriously about estate planning or protecting their assets from challenges. Indeed, they can be quite powerful when it comes to protecting assets, providing for loved ones, and ensuring your wishes are respected. But the truth is, not every situation calls for a trust, and sometimes they can be set up in ways that don’t quite hit the mark.

Let’s take a closer look at a few common pitfalls with trusts—why some are unnecessary, what happens when they’re not properly set up, and why many end up languishing in a drawer, unused and unloved.

1. Trusts: Are They Really Worth It?

One of the things I see often is people creating trusts without fully considering whether they actually need one. Trusts are sometimes sold as a one-size-fits-all solution, but they can add a lot of complexity.

So, when is a trust genuinely worth the effort, and when might a simpler approach do the job?

When a Trust Makes Sense:

- Asset Protection: If you have a significant estate and want to ensure assets are protected from potential creditors, a trust might be a good fit. They can also be useful for shielding assets from care home fees and challenges, but only in certain circumstances.

- Caring for Vulnerable Family Members: Trusts can be invaluable if you have loved ones who might need a bit more support in managing their inheritance, like a child with disabilities or a relative who might spend their inheritance too quickly.

- Tax Planning: For those with more substantial estates, trusts can play a role in managing inheritance tax. But let’s be clear, they’re not always the magic solution some make them out to be.

When You Might Be Overcomplicating Things:

- Simple Family Setups: If your main aim is to leave everything to your spouse or children, a well-drafted will often does the trick without the added complexity of a trust.

- Modest Assets: For smaller estates, the cost of setting up and maintaining a trust can sometimes outweigh the benefits. In these cases, a direct gift or a simpler will might be more sensible.

It’s always worth having a frank chat with us to weigh up the pros and cons before jumping into trust arrangements.

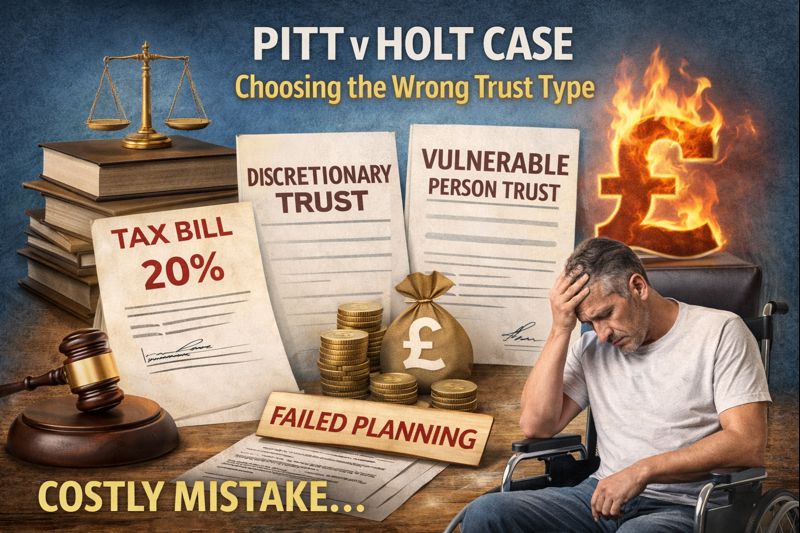

2. Improperly Constituted Trusts: When the Legal Title Doesn’t Change Hands

Setting up a trust isn’t just about signing a trust deed and declaring your intentions. A big part of making a trust work is ensuring that the trustees actually hold the legal title to the assets in question. Yet, I often come across situations where the legal title hasn’t been transferred, leaving the trust incomplete.

Why This Matters:

The essence of a trust is that the trustees hold the legal title of the assets on behalf of the beneficiaries. This means that whatever property or funds are meant to be part of the trust must be properly transferred into the trustees’ names. Without this, the trust remains a good idea on paper but doesn’t quite come to life.

The Risks of an Incomplete Trust:

- Trustees Can’t Manage the Assets: Without the legal title, the trustees don’t have the authority to manage or invest the trust assets, leaving them in a sort of legal limbo.

- Beneficiaries Left in the Lurch: If the assets aren’t legally part of the trust, beneficiaries may struggle to enforce their rights under the trust agreement.

- Tax and Compliance Issues: An improperly constituted trust can lead to complications with HMRC, especially if the tax benefits you were hoping for depend on the trust being properly set up.

How to Get It Right:

Make sure you take the necessary steps to transfer the legal title of any assets to the trustees. This might involve signing deeds, filling out stock transfer forms, or registering property changes. It’s a bit of extra admin, but it’s what makes the trust effective.

3. Severing Joint Tenancies Without a Will: A Missed Opportunity

Another issue I often see is when people sever a joint tenancy—typically with good intentions, such as ensuring their share of a property doesn’t automatically pass to their spouse. But then they forget to back this up with a will. This is a classic case of doing half the job.

The Pitfall:

When you sever a joint tenancy, you turn your ownership into a tenancy in common, which means your share of the property can be left to whoever you choose in your will. But if you don’t have a will in place, that share just ends up passing to your spouse anyway under the rules of intestacy, which is what would have happened without the severance in the first place. Councils have successfully challenged this arrangement and proven legally that the estate is still that of the surviving spouse, so the whole exercise was a pointless waste of time and money, and doesn’t offer the protection promised.

Why It’s Important to Pair Severance with a Will:

- Ensure Your Wishes Are Followed: A will is what allows you to direct where your share goes, whether it’s to children, a trust, or other beneficiaries.

- Peace of Mind for Complex Family Situations: If you have children from a previous relationship or want to ensure a fair distribution, a will can make sure your wishes are respected.

4. Inactive Trusts: Why Have One If You Don’t Use It?

It’s not uncommon to come across people who have set up a trust but then do absolutely nothing with it. Maybe they meant well, but somewhere along the line, they forgot to transfer any assets into it or keep records of their actions. The result is a trust that’s effectively gathering dust.

Why This Is a Problem:

- Wasted Money: Setting up a trust isn’t free. There are costs involved in time or money, and if the trust isn’t being used, that’s time or money down the drain.

- Legal and Tax Headaches: A trust that exists on paper but doesn’t actually manage any assets can attract unwanted attention from HMRC or create questions if it’s ever scrutinised.

- Trustee Responsibilities Are Neglected: Trustees have legal duties, including keeping records and acting in the best interests of the beneficiaries. If they aren’t doing anything, they may be failing in their responsibilities.

Making a Trust Work:

If you’re going to go through the process of setting up a trust, make sure it’s active. Transfer assets into it, keep records of meetings, and review it regularly to ensure it’s doing what you intended it to do.

Final Thoughts: Making Sure Your Trust Works for You

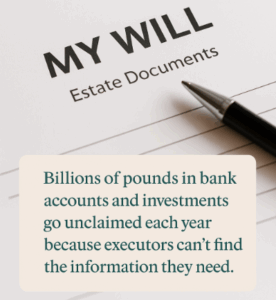

Trusts can be incredibly effective, but they need to be set up with care, managed properly, and used for the right reasons. Whether you’re considering a trust for the first time or wondering if the one you have is doing its job, it’s always wise to get professional advice tailored to your situation or get yourself on to our course. At the end of the day, a trust should make things simpler, not more complicated.

If you’d like to chat about whether a trust is right for you, or if you have one and want to ensure it’s properly managed, do get in touch. We’d be happy to offer some guidance to help you make the most of your estate planning.

2 comments