The Importance of Vulnerable Person’s Trusts in Estate Planning

Managing assets and protecting benefits for vulnerable individuals is a crucial concern for many families and caregivers. Vulnerable persons trusts, often referred to as special needs trusts, offer a powerful legal tool to ensure that individuals with disabilities or other vulnerabilities can receive the care and financial support they need without jeopardising their entitlement to essential public benefits. Here’s why establishing a vulnerable persons trust is so important.

1. Protection of Public Benefits

One of the primary reasons for establishing a vulnerable persons trust is to safeguard the beneficiary’s eligibility for means-tested government benefits, such as Employment and Support Allowance (ESA) and Universal Credit. These programmes often have strict income and asset limits. Direct inheritance or substantial gifts can disqualify an individual from receiving these benefits. A vulnerable persons trust ensures that the assets are not counted as personal assets of the beneficiary, thereby preserving their eligibility for essential support.

2. Tailored Financial Management

A vulnerable persons trust allows for customised financial planning tailored to the specific needs and circumstances of the individual. Trustees can manage and distribute the trust assets in a manner that best serves the beneficiary’s interests. This can include covering expenses that government benefits do not, such as personal care attendants, rehabilitation services, education, transportation, and recreation. The flexibility in management ensures that the beneficiary’s quality of life is significantly enhanced.

3. Legal and Financial Safeguards

Creating a vulnerable persons trust involves appointing trustees who have a fiduciary duty to act in the best interests of the beneficiary. This provides an additional layer of protection against financial abuse or mismanagement. Trustees can be trusted family members, friends, or professional fiduciaries. The trust structure also allows for the possibility of appointing a trust protector or mediator to oversee the trustees and resolve any disputes that may arise, ensuring the trust operates smoothly and effectively.

4. Longevity and Continuity of Care

A vulnerable persons trust can be structured to last for the beneficiary’s lifetime, ensuring that their needs are met long-term. This is particularly important for parents or guardians who worry about who will care for their loved one after they are gone. The trust can continue to provide for the beneficiary’s needs, ensuring continuous support without interruption. Additionally, the trust can outline specific guidelines and wishes regarding the care and lifestyle of the beneficiary, providing peace of mind to the family.

5. Flexibility and Adaptability

Vulnerable persons trusts are highly flexible instruments. They can be adapted to changing circumstances, whether it’s a change in the beneficiary’s needs or a change in public benefits law. Trustees can make distributions in various forms, such as paying for goods and services directly or setting aside funds in a way that benefits the individual without disqualifying them from benefits. This adaptability is crucial in ensuring the trust remains effective throughout the beneficiary’s life.

6. Tax Advantages

Vulnerable persons trusts can also offer tax benefits. While the trust itself may be subject to certain taxes, the assets within the trust can often grow tax-free, depending on the structure of the trust. Moreover, because the trust assets are not considered the personal assets of the beneficiary, they are also not subject to inheritance tax upon the beneficiary’s death, thereby preserving more of the trust’s assets for future use or for secondary beneficiaries.

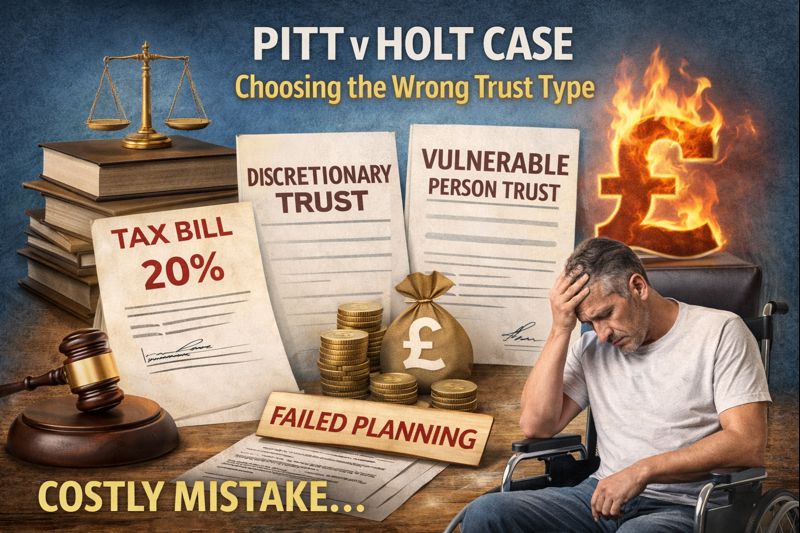

7. Avoiding Bare Trust Classification

Including an additional sibling or another beneficiary in a vulnerable persons trust can help avoid the trust being classified as a bare trust, which can have significant implications for tax obligations and the protection of benefits. Here’s why this is important:

- Discretionary Trust Benefits: A discretionary trust, which includes multiple beneficiaries, allows trustees to distribute income and capital according to the beneficiaries’ needs and circumstances. This flexibility can prevent the trust from being classified as a bare trust, where the beneficiary has an absolute right to the assets.

- Tax Efficiency: Trustees can allocate trust income to beneficiaries who are in lower tax brackets, optimising the overall tax liability.

- Eligibility Maintenance: For means-tested benefits such as ESA and Universal Credit, assets held in a discretionary trust are not considered the personal assets of the vulnerable individual. This helps maintain their eligibility for these essential benefits.

Practical Considerations

- Clear Trust Provisions:

- The trust deed should clearly outline the roles and entitlements of each beneficiary, as well as the trustees’ discretionary powers. This helps avoid any ambiguity and ensures the trust operates as intended.

- Specify the rights of each beneficiary to prevent any one beneficiary from having an absolute right to the trust assets, which could lead to the trust being classified as a bare trust.

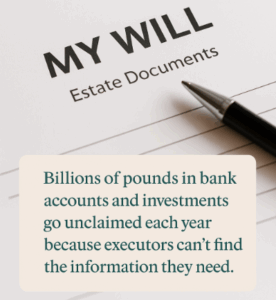

- Professional Advice:

- Working with legal and tax professionals can ensure the trust is set up correctly and complies with relevant laws. Professionals can also help in drafting trust documents that clearly define the discretionary nature of the trust.

- Regular Reviews:

- Conduct regular reviews of the trust to ensure it continues to meet the needs of the beneficiaries and complies with any changes in law or personal circumstances.

Conclusion

For a vulnerable individual in the UK, being part of a trust with multiple beneficiaries offers significant advantages. It helps maintain eligibility for public benefits, allows for tax-efficient asset management, and provides a robust framework for long-term financial support and protection. Properly structuring the trust with clear provisions and professional advice is essential to achieve these goals. Establishing such a trust with professional guidance ensures that the vulnerable individual’s needs are met effectively and sustainably.

Post Comment