Why You Need a Lasting Power of Attorney: Essential Protection at Any Age

In today’s unpredictable world, planning for the future isn’t just about securing financial stability—it’s also about ensuring decision-making capacity in unforeseen circumstances. A Lasting Power of Attorney (LPA) is a legal document that allows you to appoint one or more people to make decisions on your behalf, should you lose the ability to do so yourself. Here’s why it’s essential for everyone, not just the elderly.

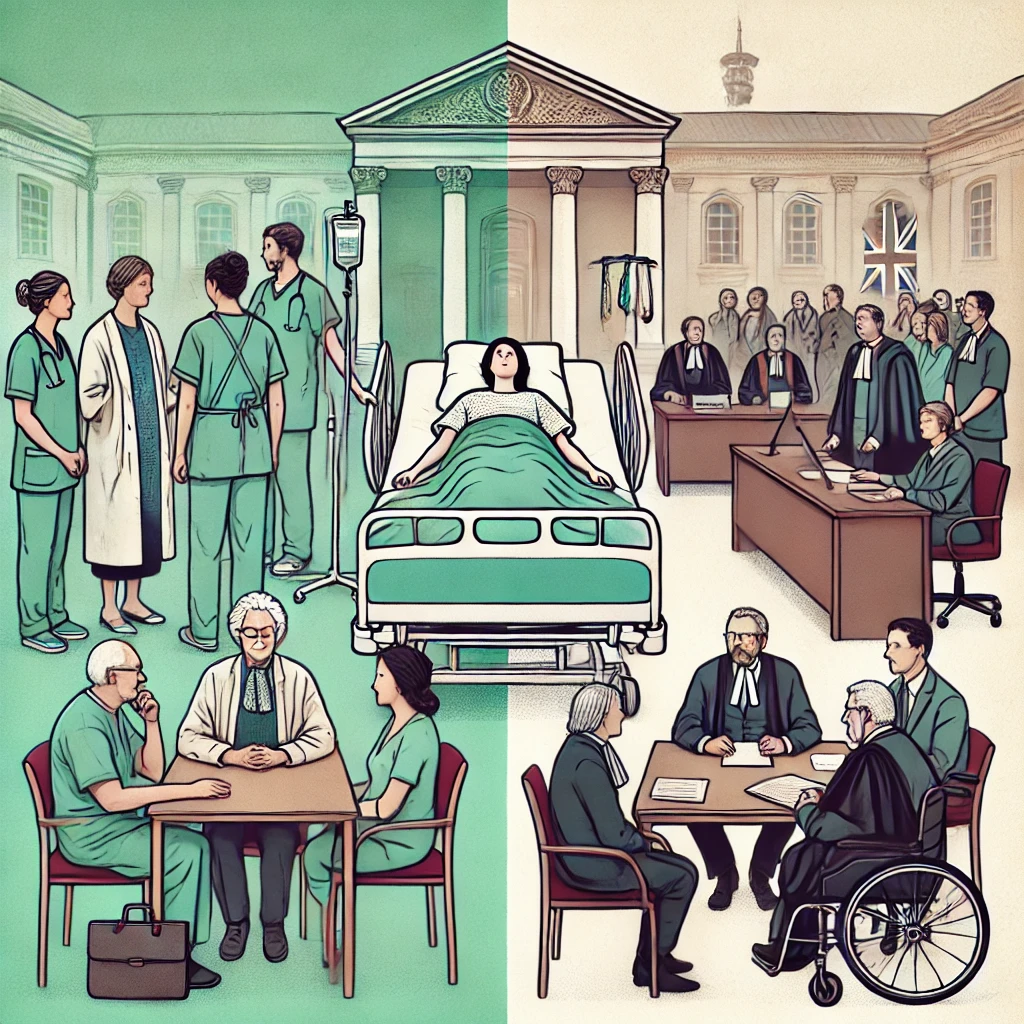

It’s Not Just for Health Issues

Many associate an LPA with old age and declining health, but it’s far broader. Young or old, accidents and sudden illnesses can happen to anyone at any time. Whether it’s a severe injury or an unexpected medical condition, an LPA ensures that your affairs are in trustworthy hands.

Covers Both Financial and Health Decisions

An LPA isn’t just about healthcare. There are two types: one for health and welfare and another for property and financial affairs. You can choose to set up one or both, depending on your needs. This means you can have trusted individuals handle your financial duties, like paying bills or managing your investments, or make crucial health care decisions, or both.

Avoids Legal Complications

Without an LPA, if you become incapacitated, your loved ones will need to go through a lengthy and costly court process to gain the legal right to act on your behalf. Setting up an LPA in advance circumvents this problem, saving time, money, and stress.

You Choose Who Makes Decisions

With an LPA, you are in control of who makes decisions for you. You can select someone you trust, who understands your preferences and values. Without an LPA, these decisions could fall to court-appointed individuals who may not know you or what you would prefer.

Peace of Mind

Knowing you have an LPA in place provides peace of mind to both you and your family. It reassures everyone that, no matter what happens, decisions will be made in your best interest, by people you have personally chosen and trust.

Flexible and Revocable

An LPA can be as flexible as you want it to be. You can specify how and when your attorneys can act, giving you complete control. Additionally, as long as you have the mental capacity, you can revoke or change your LPA, ensuring it always fits your current wishes.

In Summary

An LPA is a crucial legal tool that everyone should consider, not just those who are older or battling chronic illnesses. It’s about preparing for the unknown and ensuring that your affairs, whether personal, medical, or financial, are handled according to your wishes, should you ever be unable to manage them yourself.

Consider setting up an LPA today—it’s a simple step that can provide significant reassurance for the future.

Post Comment